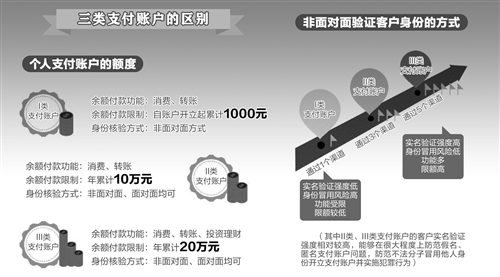

On December 28th, the central bank promulgated the Administrative Measures for Online Payment Services of Non-bank Payment Institutions, which divided personal online payment accounts into three categories based on the idea that small payment is more convenient and large payment is more secure, and the transaction limit of each category using the balance of payment accounts is different. Class I accounts are mainly suitable for customers to make small and temporary payments. In order to give consideration to convenience and security, the transaction limit of Class I accounts is relatively low, but payment institutions can upgrade Class I accounts to Class II or III accounts by strengthening customer identity verification, so as to increase the transaction limit.

On December 28th, the People’s Bank of China promulgated the Administrative Measures for Online Payment Services of Non-bank Payment Institutions, which came into effect on July 1st, 2016. The relevant person in charge of the central bank answered the reporter’s question.

Small payment emphasizes convenience, while large payment emphasizes safety.

Q: What are the regulatory ideas and main regulatory measures of the measures introduced this time?

A: The People’s Bank of China has established the regulatory thinking of adhering to the real-name registration system of payment accounts, balancing the safety and efficiency of payment business, protecting consumers’ rights and interests and promoting payment innovation. The main measures include:

The first is to clearly define the positioning of payment institutions. Adhere to the principle of small convenience and service for e-commerce, and effectively isolate cross-market risks. Second, insist on paying the account real-name registration system. This is also the basis of anti-money laundering, anti-terrorist financing and curbing illegal and criminal activities. In view of the characteristics of online payment without face-to-face account opening, the regulatory requirements for payment institutions to identify customer identity information through external multi-channel cross-verification are strengthened. The third is to give consideration to payment security and efficiency. Based on the management idea that small payment is more convenient and large payment is more secure, according to the different security levels of transaction verification, the transaction limit for using the balance of payment account is arranged accordingly, so as to guide payment institutions to adopt security verification means to ensure the safety of customers’ funds. The fourth is to highlight the protection of the legitimate rights and interests of individual consumers. Guide payment institutions to establish a sound risk control mechanism, improve customer rights protection mechanisms such as customer loss compensation and error dispute handling, and effectively reduce the risk of online payment services.

The fifth is to implement classified supervision to promote innovation. Implement differentiated management of payment institutions and their related businesses, and guide and promote payment institutions to carry out technological innovation, process innovation and service innovation on the premise of meeting basic conditions and substantive compliance.

Payment accounts are obviously different from bank accounts.

Q: What is the difference between the payment account mentioned in the Administrative Measures and the bank account?

A: The payment account was originally opened by the payment institution to facilitate customers’ online payment and solve the low trust between buyers and sellers in e-commerce transactions, which is obviously different from the bank account.

First, the subjects providing account services are different. Payment accounts are opened by payment institutions for customers, which are mainly used for payment settlement of e-commerce transactions. Bank accounts are opened by banking financial institutions for customers, and the account funds are used not only for payment and settlement, but also for the purpose of maintaining and increasing value.

Second, the nature and guarantee mechanism of account fund balance are different. The balance of the payment account is similar to the balance in the prepaid card, which is deposited in the bank by the payment institution in its own name and actually controlled by the payment institution. This balance is not protected by the deposit insurance regulations. Once the payment institution has operational risk or credit risk, it may cause customers to suffer property losses.

Personal payment accounts are divided into three categories.

Q: How to manage personal online payment accounts?

A: The classification of payment accounts, taking into account the safety and efficiency of payment, can meet the diversified needs of different customers and show respect for customers’ right to choose.

Methods Individual payment accounts are divided into three categories. Among them, Class I accounts only need an external channel to verify the customer’s identity information (for example, online verification of resident identity card information), and the account balance can be used for consumption and transfer, which is mainly suitable for small and temporary payment of customers, and the identity verification is simple and fast. In order to give consideration to convenience and security, the transaction limit of Class I accounts is relatively low (the balance payment limit is the accumulated 1000 yuan since the account was opened), but payment institutions can upgrade Class I accounts to Class II or III accounts by strengthening customer identity verification, so as to increase the transaction limit.

Class II and III accounts have relatively high real-name verification intensity, which can prevent the problems of pseudonyms and anonymous payment accounts to a certain extent, and prevent criminals from opening payment accounts and committing crimes by using other people’s identities, so they have high transaction limits (the balance payment limit is 100,000 yuan and 200,000 yuan annually). In view of the high risk level of investment and wealth management business, the measures stipulate that only Class III accounts with the highest real-name verification intensity can use the balance to purchase financial products such as investment and wealth management to ensure the safety of customers’ funds.

Customers are not subject to the limit for fast payment of bank cards.

Q: Will the transaction limit of payment account affect the convenience?

A: Online payment should always adhere to the purpose of providing small, fast and convenient micro-payment services for the society. The annual cumulative limit of Class II and Class III personal payment accounts is 100,000 yuan and 200,000 yuan, which can meet the needs of most customers to use the "balance" of payment accounts for payment. For a very small number of consumers, or the occasional large payment by consumers, it can be completed through the combination of payment account balance payment, bank card fast payment, bank gateway payment and so on. Considering that the strength of customer identity verification in the opening process of Class I personal payment account is weak, a lower limit is set for its "balance" payment transaction.

At the same time, in order to guide payment institutions to improve the security of transaction verification methods, the measures stipulate that for the "balance" payment transactions of payment accounts with high security level of transaction verification, payment institutions can independently agree with customers on a single-day cumulative limit; However, for the "balance" payment transaction of the payment account with insufficient security level, the method stipulates the one-day cumulative limit. The limit of accumulating 1000 yuan and 5,000 yuan per day can effectively meet the needs of most customers to use the "balance" of their payment accounts for payment. In addition, the single-day payment limit of payment institutions with higher comprehensive rating and better implementation in real-name registration system can be increased to twice the existing limit at most.

It should be emphasized that the annual cumulative limit of 100,000 yuan and 200,000 yuan, as well as the single-day cumulative limit of 5,000 yuan in 1000 yuan, are only for individual payment account "balance" payment transactions. Customers make bank gateway payment and bank card express payment through payment institutions, and the annual cumulative limit and one-day cumulative limit are independently agreed by payment institutions, banks and customers according to relevant regulations, and are not subject to the above limits. (Reporter Chen Guojing)